Comparing Free vs Paid Budget Apps for Families

Keeping a family budget on track isn’t always as simple as balancing the books once a month. With rising food prices, unexpected school expenses, subscription creep, and juggling multiple incomes, many households find that budgeting apps help structure and clarify their financial lives.

But here’s the big question: Should you stick with a free app or pay for a premium budgeting tool?

The answer depends on your family’s lifestyle, financial complexity, and how hands-on (or hands-off) you want to be. In this blog, we’ll break down the key differences between free and paid options, highlight the best tools in each category, and help you decide which is worth your time – and possibly your money.

Why families use budgeting apps in the first place

Traditional budgeting often involved spreadsheets, calculators, and plenty of guesswork.

But modern tools now:

- Sync directly with bank accounts and credit cards

- Provide real-time updates and categorisation

- Flag overspending and duplicate subscriptions

- Offer shared access between partners or family members

- Support goal setting and long-term planning

Whether you’re saving for a summer holiday or just trying to keep your grocery bill under control, these apps can reduce stress, save time, and create a shared financial overview for everyone involved.

What free budgeting apps offer

Free apps are a great way to dip your toes into budgeting. They often include enough core features to get you started, and many families never need to pay a penny.

Key benefits of free apps:

- No upfront or ongoing cost

- Usually connect to major UK banks

- Basic category tracking (food, transport, housing, etc.)

- Visual breakdowns of spending

- Some offer goal tracking or alerts

Top free budget apps to consider:

1. Emma (Free tier)

Emma connects to your accounts and categorises your spending automatically. Even on the free plan, it offers spending summaries, transaction search, and bill tracking.

2. Snoop

Built to help you spot waste and get better deals, Snoop reviews your transactions and suggests money-saving tips, including identifying unused subscriptions.

3. Money Dashboard

Though it’s winding down operations, it’s still worth a brief mention as it paved the way for others with its envelope-style tracking and cash flow projections.

Free apps work well for:

- Families with simple budgeting needs

- Households just starting to track spending

- Those comfortable checking multiple accounts manually

What paid budgeting apps add to the mix

Premium budgeting tools go beyond the basics to offer automation, forecasting, and deeper insights. These are ideal for families managing multiple income streams, savings goals, or variable budgets month to month.

Benefits of paid budgeting tools:

- Real-time syncing across devices and users

- Advanced categorisation and custom tags

- Predictive analysis for upcoming bills or cash flow

- Built-in savings challenges or investment options

- Ad-free experiences and priority support

Best paid budgeting apps for families:

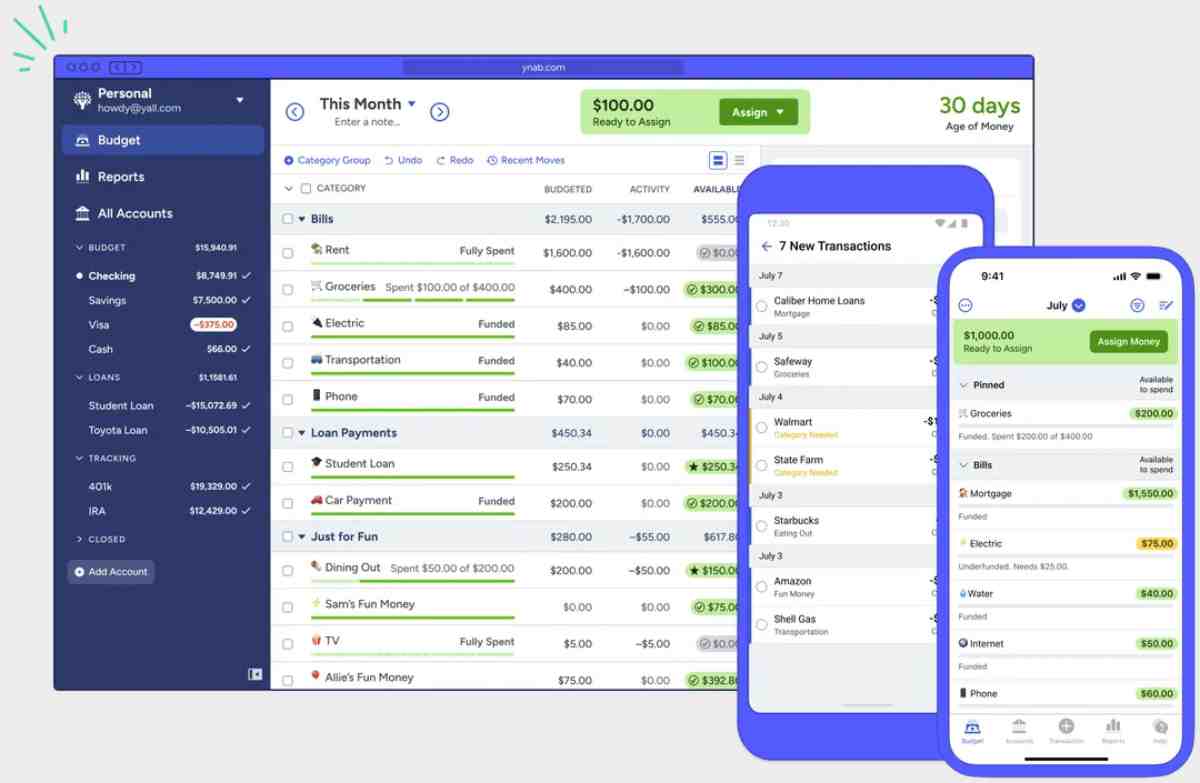

1. YNAB (You Need a Budget)

YNAB is probably the most detailed and disciplined system around. It teaches you to give every pound a job, live on last month’s income, and adjust dynamically. It’s great for committed users.

2. Plum Pro

This AI-powered tool links with your accounts to automatically save, invest, and track spending. The paid tier unlocks retirement projections, budget builders, and smart nudges.

3. Emma Pro

If you’ve already tried the free version, upgrading to Emma Pro adds features like custom categories, export tools, cashback offers, and deeper analytics.

Paid apps work best for:

- Families juggling variable income or freelance work

- Those saving for big goals (home, education, travel)

- People who benefit from automation and reminders

How to choose the right option for your family

Here are some quick questions to help guide your choice:

Do you just want to see where your money goes?

Start with a free app like Snoop or Emma Free.

Need to budget across multiple people or accounts?

Try YNAB or Emma Pro.

Do you hate manually saving money?

Plum’s AI-based automation might be perfect for you.

Want to teach your teen about money?

Combine an adult budgeting app with kid-friendly tools like GoHenry, which also benefit from structured budgeting practices.

If you’re working on a shared family budget on Google Sheets, pairing it with an app can bring automation and accuracy into the mix.

Consider hidden costs and value

While free apps are easy on the wallet, they may:

- Display ads

- Offer fewer personalisation options

- Lack of long-term forecasting or automation

On the flip side, paid tools (usually £4 to £11 per month) need to earn their keep.

Ask:

- Does this app save us more than it costs?

- Does it reduce stress or manual effort?

- Will we actually use the extra features?

Remember: a paid app is only valuable if it fits your lifestyle and simplifies your financial tasks.

Blending free and paid options

Some families use a hybrid approach.

For instance:

- Use Google Sheets for monthly planning

- Emma Free for spending alerts

- Plum Pro for automatic savings

This way, you get the benefits of structure, awareness, and automation without paying for multiple overlapping tools.

To learn more about how automation can simplify your setup, check out our post on using AI tools for smarter family budgeting.

Final thoughts: free vs paid budgeting apps

The best app isn’t always the most expensive one—it’s the one that fits your family’s needs, habits, and goals. Free apps are fantastic entry points and are surprisingly capable, but premium budgeting tools offer features that can transform the way you manage money together.

Try a few. Test their features. See which ones make budgeting feel easier, not harder.

And remember: budgeting isn’t about restriction. It’s about clarity, choice, and confidence.

Start where you are. Grow from there.