Using AI Tools for Smarter Family Budgeting

Let’s be honest: budgeting for a family in today’s world can feel like spinning plates. One minute you’re on top of bills and saving for a holiday, the next you’re knee-deep in surprise school fees, soaring grocery bills, or a new pair of trainers your child outgrew before even wearing. It’s hard enough juggling household demands without having to stress over spreadsheets and bank statements.

That’s where artificial intelligence (AI) is stepping in to help. AI is no longer reserved for tech giants or futuristic sci-fi. It’s now sitting quietly in your pocket, ready to support your family’s finances. With the right tools, you can automate budgeting, track spending trends, and even receive personalised advice that adapts as your situation changes.

In this post, we’ll explore how families across the UK are using AI family budget planners and smart budgeting tools to reclaim control over their money, reduce financial stress, and save smarter.

Why AI matters in family budgeting

AI tools don’t just track what you spend – they learn from it.

These systems process thousands of financial data points to help you:

- Spot hidden trends in your spending habits

- Receive nudges when you’re overspending

- Automatically categorise expenses

- Forecast future costs based on past behaviour

- Suggest ways to save, invest, or manage debt

Unlike a standard spreadsheet or banking app, AI-driven platforms adapt. They notice, for example, if your grocery bill creeps up or your subscription costs multiply. And they offer proactive solutions before things spiral.

For busy families trying to juggle work, school runs, budgeting, and life, these tools act as a silent partner in keeping your financial health in check.

Best AI family budget planners in 2025

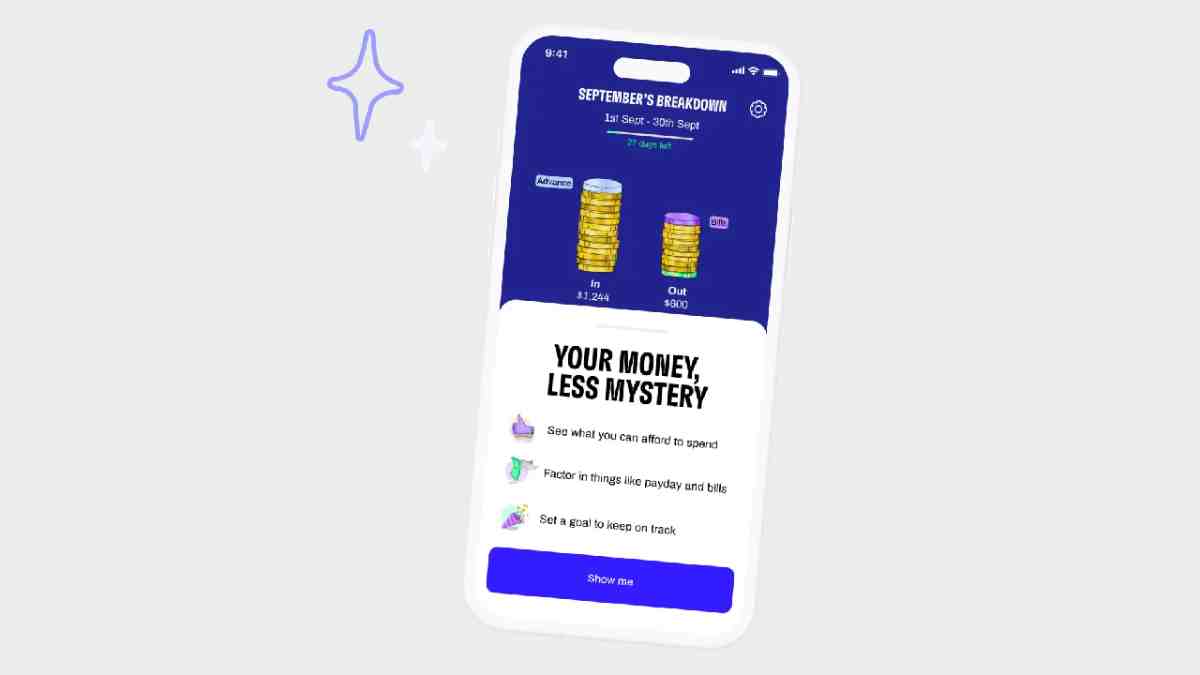

1. Cleo

Cleo combines AI with a chatbot interface, offering a friendly, casual way to monitor spending and saving. Families love its simplicity and humour – it makes financial chats feel less intimidating.

Key features:

- Analyses your spending patterns and offers advice

- Tracks subscriptions and bills

- Offers challenges to help you save money

2. Plum

Plum is an AI-powered money assistant that links with your bank accounts, analyses your cash flow, and automatically sets aside money for saving, investing, or bills.

Best for: Families looking for hands-off saving, without the need to micromanage.

3. Emma

Emma is a top choice for UK users who want real-time insights. It categorises all transactions and provides AI-backed alerts for wasteful spending.

Smart features:

- Subscription detection

- Overspending alerts

- Cash flow forecasts

Emma also allows joint account tracking, perfect for collaborative budgeting among family members.

Automating savings and expense tracking

Imagine this: you’re sipping your morning tea, and your AI assistant pings you to say your water bill was unusually high last month, suggests comparing suppliers, and shows you how much you could save over the year.

That’s not fantasy – it’s how tools like Snoop or Moneyhub work.

Benefits of automation in family budgeting:

- Never miss a bill payment

- Spot duplicate charges or price hikes

- Separate essential vs. non-essential spending

- Automate savings for holidays, birthdays, or back-to-school

AI doesn’t just track. It acts.

Teaching kids smart money habits with AI tools

Financial literacy starts at home. And AI tools are becoming great educational companions for children and teens learning how to manage money.

Platforms like GoHenry and HyperJar use AI insights to:

- Assign chores and track completion

- Auto-allocate pocket money

- Encourage saving goals

- Provide spending breakdowns in child-friendly formats

These tools teach kids independence, help them form early budgeting habits, and start conversations around money that feel natural, not forced.

If you’re already working towards a shared family budget on Google Sheets, AI tools can take things further by adding automation and insights across every device.

AI helps with long-term planning, too

Short-term budgets are vital. But AI shines when helping families think ahead.

With predictive algorithms, these platforms estimate:

- Upcoming bills or seasonal expenses

- Debt repayment timelines

- How much to save monthly to reach big goals (e.g. buying a house, funding university)

You can even simulate future financial scenarios – what if your income drops? What if energy prices spike? AI helps prepare you before a problem hits, rather than reacting too late.

Common myths about AI budgeting tools

Let’s clear the air. Some families are hesitant to use AI in their finances due to outdated misconceptions.

Myth 1: It’s only for tech-savvy people

Reality: Most apps are as simple as WhatsApp. Tap, swipe, read insights.

Myth 2: It replaces you

Reality: AI doesn’t decide. It suggests, supports, and simplifies. You stay in control.

Myth 3: It’s unsafe

Reality: Most AI finance tools use bank-level encryption and don’t store login credentials. Always read privacy terms, but most major tools prioritise your data security.

Choosing the right AI tool for your family

Every family is different, so the best tool depends on your lifestyle.

For hands-off savers: Plum or Chip

For spreadsheet lovers: Pair Google Sheets with Emma or Moneyhub for hybrid planning

For families with teens: GoHenry or HyperJar

For visual learners: Emma or Snoop

If you’re curious about a hybrid approach, consider combining an AI planner with insights from your monthly family budget to get both structure and automation.

Conclusion: Technology with a human touch

Budgeting used to be something we tackled with envelopes, calculators, and crossed fingers. But in 2025, it’s smarter, faster, and more collaborative than ever.

With AI on your side, managing a family budget no longer means late-night worry or last-minute scrambles. These tools don’t just track your money — they understand your habits, suggest improvements, and help you build a future with more confidence and less guesswork.

Whether you’re trying to teach your kids about saving, coordinate with your partner, or simply cut down on financial surprises, AI family budget planners give you a quiet but powerful edge.

Start small. Pick one tool. Sync it with your account. Let it learn. Then watch your finances become clearer, calmer, and more in tune with the life you want to lead.