Budgeting Templates and Tools for Busy Parents

Trying to manage your finances as a busy parent can feel like spinning plates—one for the food shop, another for childcare, another for bills and school trips, all while dodging the occasional unexpected expense. Sound familiar?

If you’re juggling family life and trying to organise your household budget, you’re not alone. In fact, money is one of the top stressors for UK families. But here’s the good news: with the right budgeting tools and a simple family budget template, you can bring calm to the chaos.

You don’t need to be a spreadsheet expert or spend hours every week crunching numbers. Modern budgeting tools — from printable planners to clever apps — can make tracking, planning and saving quicker and easier than you think.

This blog explores the best tools and templates to help you stay on top of your money, even when life gets hectic. We’ll also share real-world tips and honest advice tailored specifically for parents who are short on time but big on responsibility.

Why Budgeting Matters More When You’re a Parent

Let’s be honest — parenting comes with expenses that grow faster than your kids do. From nappies and lunchboxes to smartphones and football boots, it adds up fast. But what makes budgeting essential is how unpredictable family life can be.

Key Reasons Parents Need a Strong Budget System

- Unpredictable costs: Children’s needs change constantly — one month it’s new shoes, the next it’s a school trip or dental visit.

- Multiple incomes (or lack thereof): If you’re navigating freelance work, maternity leave, or a single-income household, structure becomes crucial.

- Shared financial responsibility: You may be budgeting with a partner, ex-partner, or even supporting extended family.

- Time is limited: You don’t have hours to manually balance a budget each week — you need fast, effective tools that fit into family life.

What Makes a Great Family Budget Template?

A budget template isn’t just about listing expenses. It’s a tool to give you clarity, control and confidence.

A well-designed one should:

- Be simple to update (because your time is precious)

- Account for monthly, annual and one-off costs

- Help you track income from multiple sources

- Show you where your money goes — without judgement

- Be accessible for both partners (if budgeting together)

Let’s explore the different types of tools available so you can choose the one that best suits your personality and parenting schedule.

Paper-Based Budgeting Tools: For Visual Thinkers

Sometimes, the old-fashioned way works best, especially if you prefer writing things down or want to involve older kids in learning about money.

Printable Budget Templates

These can be stuck to the fridge or pinned to a home command centre. Choose from:

- Monthly household budget planners

- Weekly expense trackers

- Sinking fund trackers (for birthdays, holidays, or school fees)

- Debt payoff charts

You can find dozens of free downloadable templates online, or make your own using a table and some coloured pens. Websites like Vertex42 and Canva offer beautiful, customisable options.

Envelope Budgeting

This classic method involves allocating cash to envelopes marked for each spending category. It works wonders if you’re prone to overspending or want to teach kids budgeting basics with pocket money.

Note: You can also apply the envelope system digitally through certain apps — more on that shortly.

Spreadsheet Templates: For Custom Control

If you love ticking boxes and tracking data (or have a spreadsheet-savvy partner), templates in Google Sheets or Excel give you flexibility and detail without needing fancy software.

Benefits of Spreadsheet Budgeting:

- Fully customisable to your family’s needs

- Shared access via Google Drive — perfect for couples

- Visual graphs and auto-sums help spot overspending quickly

- Easily scalable as your family or income changes

Many parenting bloggers and personal finance sites offer free downloadable templates. One of the most useful tools is a shared family budget spreadsheet, which both parents can access and update in real time, especially handy for working households or co-parents.

If you’d like to get started, here’s a great guide on how to set up a shared family budget on Google Sheets that walks you through the process.

Budgeting Apps: For Parents on the Go

If your phone is practically an extension of your arm (we get it, calendars, class WhatsApp groups and all), then a mobile budgeting app might be your best friend.

Top Budgeting Apps for Families

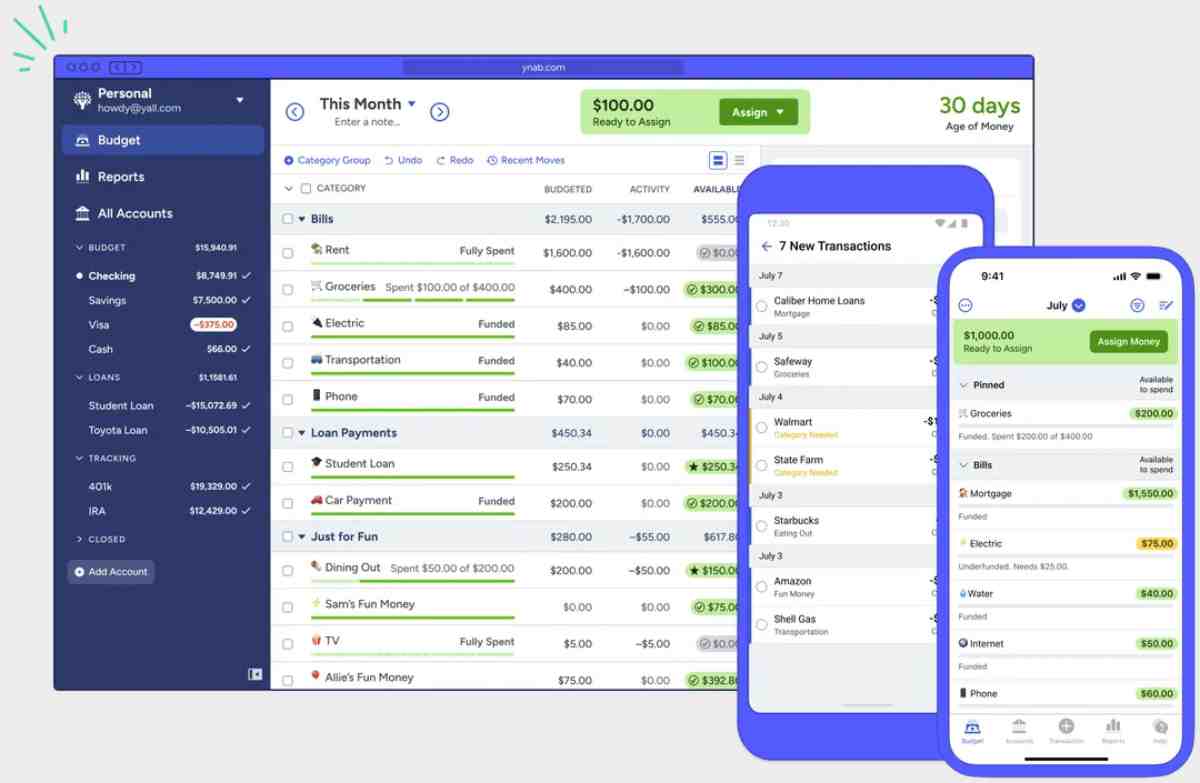

1. YNAB (You Need A Budget)

- Excellent for zero-based budgeting

- Helps you “give every pound a job”

- Ideal for families managing debt or saving for specific goals

- Has a bit of a learning curve, but worth it

2. Emma

- Connects to UK bank accounts

- Categorises spending automatically

- Flags wasteful subscriptions

- Great visual interface

3. Moneyhub

- Offers insights into spending patterns

- Secure, FCA-regulated

- Allows goal setting and planning for future costs

4. Snoop

- Tracks all spending and offers tips for cutting costs

- Brilliant for families who want to optimise everyday expenses

Key Features to Look For:

- Multi-device access (you + your partner)

- Budget category customisation

- Alerts for overspending or upcoming bills

- Visual summaries to keep things clear

Apps save time and reduce friction, especially useful if your energy is going into homework battles and dinner prep.

Digital Wallets & Automation: For Effortless Organisation

The less you have to think about budgeting, the more likely it is to stick.

Automate Where You Can:

- Standing orders for savings on payday

- Scheduled transfers for sinking funds

- Separate accounts for bills vs. daily spending

Some banks, like Monzo and Starling, offer “pots” — sub-accounts where you can ring-fence money for groceries, fuel, or Christmas gifts. You can even label them with emojis or goals, making it surprisingly satisfying.

Real Example:

Sarah, a mum of three in Leeds, uses Monzo pots labelled “Bills,” “Kids’ Stuff,” “Christmas Fund,” and “Treats.” Her income is split automatically each payday. She told us, “It’s like having little wallets—I don’t need to think about it once it’s set up.”

Combining Tools: What Works in Real Life

Most parents use a mix of budgeting tools, depending on their family’s needs and personalities. The trick is finding a system that feels natural, not forced.

Example Combinations That Work:

- Google Sheet + YNAB: For a couple managing variable income and debt.

- Printable calendar + Monzo pots: For parents who prefer visuals but want digital convenience.

- Emma app + sinking fund spreadsheet: For families who want automated tracking but custom savings plans.

Don’t worry about finding the “perfect” tool. Focus on what feels manageable and intuitive.

Common Pitfalls to Avoid When Using Budget Tools

Even with the best tools, a few habits can undermine your efforts.

1. Skipping the Monthly Check-In

No tool will work unless you use it. Set a reminder on your phone for a 15-minute family budget review each month.

2. Overcomplicating the System

You don’t need five apps and three spreadsheets. Choose one or two tools you can stick with.

3. Not Including All Incomes

Don’t forget side hustles, benefits, or child maintenance when setting your template.

4. Ignoring Annual Expenses

Birthdays and boiler services still happen — spread the cost over the year using a sinking fund tracker.

If you find it hard to stay motivated, learning how to stop overspending without feeling deprived can help reset your relationship with money.

Conclusion: A Budget That Fits Your Family, Not the Other Way Around

Parenting is hard enough without money worries keeping you up at night. The right budgeting tools can take you from overwhelmed to in control, without demanding hours of your time or a finance degree.

Whether it’s a simple family budget template pinned to your fridge, a clever app that handles everything from your phone, or a hybrid of both, the goal is the same: clarity, ease, and peace of mind.

Start small. Test what works. Adjust along the way.

Because the best budgeting tool is the one that helps you sleep better, spend smarter, and build the life you want for your family — one pound at a time.