Understanding Foreclosed Homes: Opportunities and Challenges

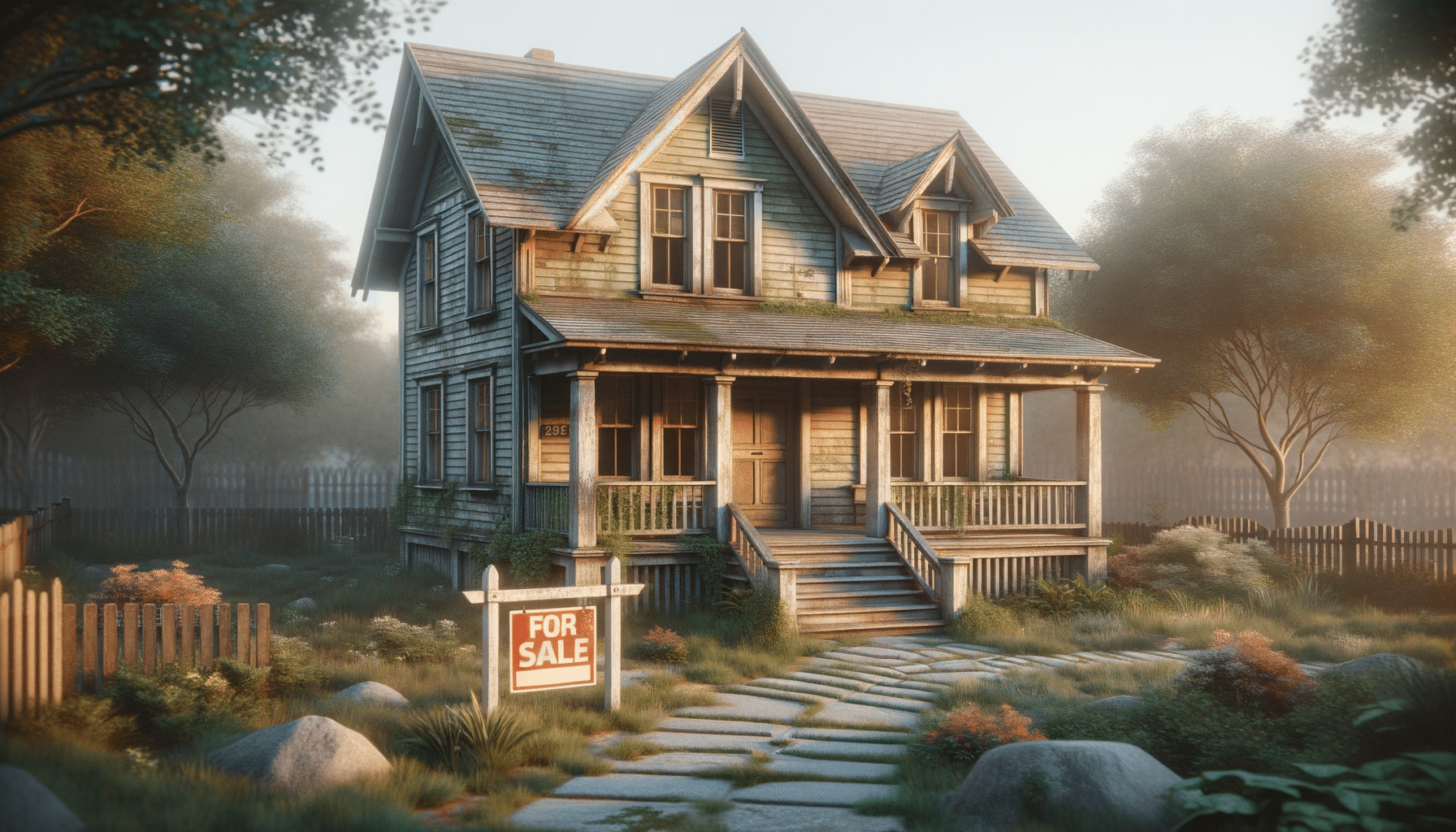

Introduction to Foreclosed Homes

Foreclosed homes present a unique opportunity in the real estate market, often attracting buyers with the promise of reduced prices. Understanding the intricacies of purchasing such properties is crucial for making informed decisions. This article delves into the essential aspects of foreclosed homes, providing insights into the processes, benefits, and potential pitfalls involved.

The Process of Foreclosure

Foreclosure is a legal process initiated when a homeowner fails to meet mortgage payment obligations, allowing the lender to recover the loan balance by selling the home. The process typically begins with a notice of default, followed by a period where the homeowner can rectify the situation. If unresolved, the property is auctioned or repossessed by the lender. Understanding this sequence is vital for buyers considering foreclosed homes, as it affects the availability and condition of the property.

Key stages in foreclosure include:

- Pre-foreclosure: The homeowner is notified of default and given a chance to resolve the debt.

- Auction: If unresolved, the home is sold at a public auction to the highest bidder.

- Bank-owned (REO): If unsold at auction, the property becomes bank-owned, often listed for sale through real estate agents.

Opportunities in Buying Foreclosed Homes

Purchasing a foreclosed home can offer significant financial benefits. These properties are often priced below market value, providing opportunities for savvy buyers to invest in real estate at a reduced cost. Additionally, foreclosed homes may offer potential for value appreciation, especially in recovering markets. Buyers can capitalize on these opportunities by conducting thorough research and working with knowledgeable real estate professionals.

Benefits include:

- Potential for significant savings compared to traditional home purchases.

- Opportunity to invest in desirable locations at a lower entry price.

- Possibility of negotiating favorable terms with motivated sellers, such as banks looking to offload inventory.

Challenges and Risks

While foreclosed homes can be attractive, they come with inherent risks. Properties are often sold “as-is,” meaning buyers may inherit issues like structural damage, unpaid taxes, or liens. The competitive nature of auctions can also lead to bidding wars, driving up prices unexpectedly. Moreover, the legal complexities of foreclosure require careful navigation to avoid potential pitfalls.

Challenges to consider:

- Properties may require significant repairs or renovations.

- Legal and financial complexities, such as outstanding liens or encumbrances.

- Potential for high competition, particularly in auctions.

Steps to Successfully Purchase a Foreclosed Home

To navigate the complexities of buying a foreclosed home, prospective buyers should follow a strategic approach. Start by getting pre-approved for a mortgage to understand your budget. Research the market and identify properties that fit your criteria. Engage a real estate agent experienced in foreclosures to guide you through the process. Conduct thorough inspections and due diligence to uncover any hidden issues. Lastly, be prepared for a potentially lengthy closing process, as banks may have specific requirements.

Essential steps include:

- Pre-approval for financing to establish a realistic budget.

- Engaging knowledgeable real estate professionals.

- Conducting comprehensive inspections and research.

- Understanding and preparing for the auction process, if applicable.