Smart Budgeting for Self-Employed Parents

Being self-employed offers a kind of freedom that’s hard to beat. You set your hours, choose your projects, and avoid the 9-to-5 grind. But let’s not sugar-coat it — when you’re a parent trying to manage a household on unpredictable income, freedom often walks hand in hand with financial anxiety.

Your income changes month to month. One project might bring in a chunk of cash; the next few weeks might be worryingly quiet. Meanwhile, the responsibilities of parenthood don’t pause — the rent’s due, packed lunches still need making, and your youngest just outgrew all their clothes again.

So, how do you create a family budget that holds up when your earnings fluctuate like the British weather?

In this guide, we’ll explore practical, realistic strategies for building a self-employed family budget that works. From setting baselines and building buffers to planning for the unexpected, you’ll discover how to navigate freelance finances with confidence — and maybe even a little breathing space.

Why self-employed parents need a different approach

When you’re paid regularly, budgeting is relatively straightforward. You know what’s coming in, so you can plan what goes out. But freelancers and gig workers operate in an entirely different financial rhythm.

One month, you might make more than you expected. Next, you’re chasing unpaid invoices or living off your savings. And if you’re juggling parenting duties on top, the stakes are even higher.

This doesn’t mean you can’t plan — it just means you need to budget differently:

- You need flexibility over rigidity.

- You need buffers over assumptions.

- And you need to be proactive, not reactive.

The good news? With the right systems in place, you can gain stability, even with an unpredictable income.

Step one: Understand your income patterns

Start with the facts.

Take the last 6–12 months and look at:

- Your lowest monthly income

- Your average monthly income

- Your highest monthly income

This gives you a clear range to work with. Use your lowest income month as your baseline for planning, not your best month, and definitely not your average.

This way, if your income dips, you’re still covered. And when it rises, you can save or invest the extra.

Build a tiered family budget

A single, fixed budget doesn’t work for unpredictable income. Instead, create a tiered budgeting system.

Tier 1 – The Essentials Budget

This includes the bare minimum you need to keep your household running:

- Rent or mortgage

- Utilities

- Groceries

- Childcare

- Debt repayments

- Basic transport and internet

Your goal? Ensure this is always covered — even in a low-income month.

Tier 2 – The Comfortable Budget

This layer adds in extras that improve the quality of life:

- Kids’ activities

- Occasional takeaways or treats

- Modest entertainment

- Contributions to savings pots

You fund this when you’ve made enough to cover essentials plus a bit more.

Tier 3 – The Growth Budget

This includes long-term goals and nice-to-haves:

- Holiday savings

- Home upgrades

- New tech

- Investments or large purchases

This tier only kicks in during high-earning months.

If you’ve already explored variable budgeting, our post on how to budget when your family income changes monthly dives deeper into adapting monthly plans to match real earnings.

Pay yourself a steady “salary”

One powerful trick is to separate earning from spending. Even if your income is inconsistent, you can still create stability by paying yourself a fixed monthly amount.

Here’s how it works:

- All income goes into a business or buffer account.

- You pay yourself a set amount each month — enough to cover Tier 1 and some of Tier 2.

- Leave the rest in your buffer for leaner months or unexpected expenses.

This smooths out the highs and lows and allows you to live on a consistent budget — no more rollercoasters.

Prioritise your savings strategy

When you’re self-employed and parenting, saving becomes survival, not a luxury.

Build two key savings buffers:

- Emergency Fund

- Covers unexpected personal expenses (e.g., medical, car repair)

- Aim for 3–6 months of essential living costs

- Keep it in a high-interest, instant-access savings account

- Income Buffer (Freelancer Float)

- Covers business-related slow periods or gaps between projects

- Start with one month’s income and build up to three

- Use it to “pay yourself” during quiet months

Saving little and often works best. Aim to save 15–30% of each payment — more in the good months, less when it’s tight.

Are you struggling to separate savings goals? Our post on emergency funds as a safety net explains how to build peace of mind step by step.

Budget for business expenses and taxes

As a self-employed parent, your work and personal finances can easily merge. That’s why it’s essential to separate personal from business costs.

Create a dedicated account for:

- Work tools and subscriptions

- Travel or workspace expenses

- Insurance

- Tax payments (20–30% of each invoice is a good rule)

Track all business expenses and keep digital receipts. If you prefer manual control, use accounting software like FreeAgent, QuickBooks, or a simple Google Sheet.

And remember — tax isn’t once a year. It’s ongoing. Putting money aside after each job avoids that dreaded January panic.

Make the most of irregular income with sinking funds

Kids’ birthdays. Christmas. Car repairs. Back-to-school. These aren’t surprises — yet they often catch us off guard.

The solution? Sinking funds — small monthly contributions into savings pots for known (but irregular) expenses.

Examples:

- £30/month for Christmas

- £20/month for school supplies

- £50/month for holidays

- £15/month for kids’ sports kit or activities

This reduces stress, builds consistency, and avoids wiping out your emergency fund for predictable costs.

Choose tools that work for your lifestyle

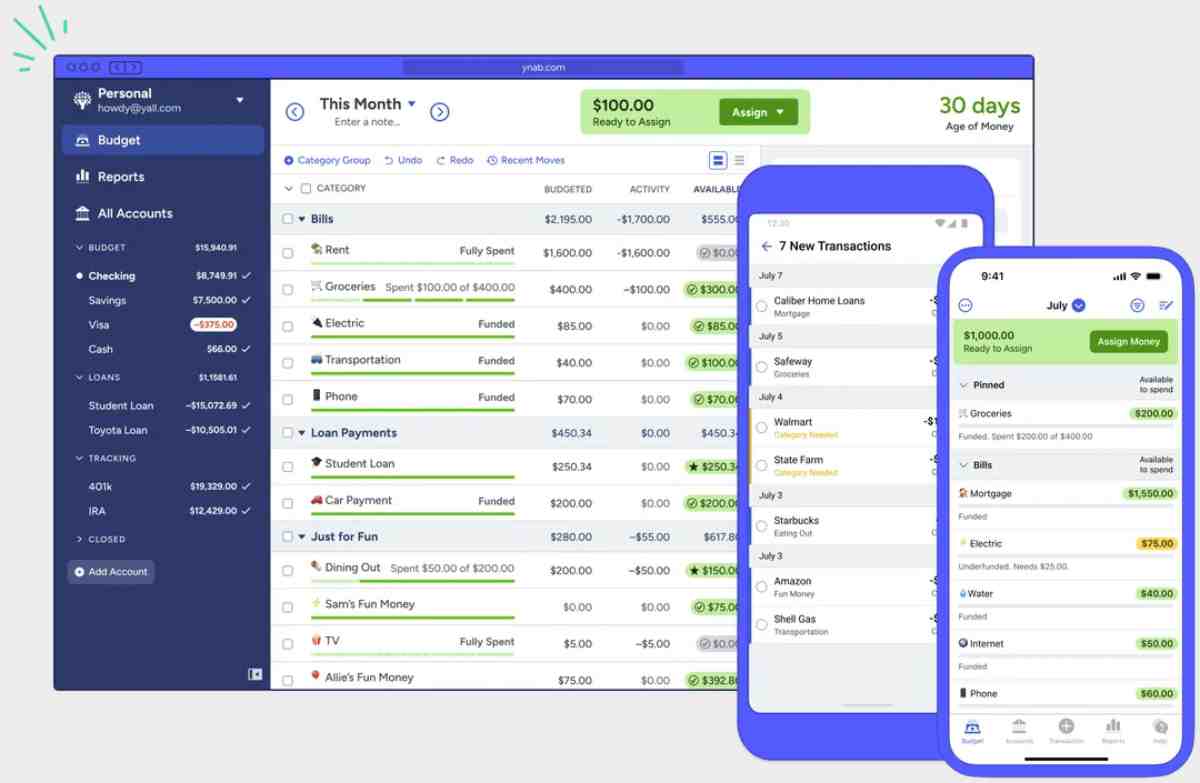

There are plenty of apps and tools that simplify budgeting and help you stay on track.

Budgeting apps to explore:

- YNAB (You Need A Budget): Ideal for envelope-style budgeting

- Money Dashboard or Emma: Tracks spending patterns and categories

- Starling Spaces or Monzo Pots: Great for separating savings goals

- Notion or Trello: For visual project and finance planning

The best system is the one you’ll actually use. So don’t overcomplicate it. Keep it visible, simple, and adjustable.

Involve your family in the process

Your budget doesn’t exist in a vacuum — your partner and children live it too.

Make budgeting a team sport:

- Hold a monthly “money chat” to review income and plans

- Share what’s coming up (big payments, quiet periods, family events)

- Involve kids in setting goals — even simple ones like saving for a bike or a day out

This builds a household mindset of awareness, teamwork, and resilience, rather than fear or secrecy.

Stay grounded during high and low months

When the money’s flowing, it’s tempting to upgrade everything. When it’s not, panic can set in.

Fight both urges with perspective:

- Use good months to stabilise, not splurge

- Use lean months to review, not react

- Always return to your Tier 1 budget first

- Celebrate the flexibility freelancing gives, but support it with structure

Your goal isn’t just to survive each month. It’s to build a life where your income supports your family’s values, goals, and well-being — even when it’s unpredictable.

Conclusion: Freedom and structure can co-exist

Being a self-employed parent is one of the most demanding — and rewarding — roles you can take on. You’re building a career on your own terms while raising a family. That’s no small feat.

The path isn’t always easy. But with a thoughtful budget, strong buffers, and smart systems, you can transform chaos into clarity. You’ll stop reacting to every income dip and start responding with purpose.

So, start today. Review your last few months. Create your essential tier. Build your buffers, one small win at a time.

And trust this — structure doesn’t limit your freedom. It protects it.