Managing Wedding or Graduation Expenses as a Parent

Weddings and graduations mark monumental moments in your child’s life — emotional milestones, rites of passage, and deeply personal celebrations. They are the days you’ll look back on with pride and joy. But let’s face it — they can also wreak havoc on your family finances if left unchecked.

Whether your child is donning a cap and gown or walking down the aisle, it’s easy to get swept up in the excitement (and pressure) of the event. Every well-meant suggestion — the venue upgrade, the photo package, the catering — can add hundreds, if not thousands, to the final bill.

And here’s the challenge: as a parent, you want the best for your child, but you also need to protect your household budget. That’s where smart planning, financial boundaries, and practical strategies come in.

This guide explores how to approach wedding and graduation expenses with clarity and confidence, offering family celebration budget advice that puts joy first and guilt last.

Why celebrations often come with budget blind spots

It starts small. A deposit here, a little splurge there. But before you know it, you’ve committed to a flower arch your daughter saw on Instagram or agreed to a graduation dinner for 40 extended relatives.

The emotional weight of milestones—particularly weddings—often blurs the line between wants and needs. We tell ourselves, “It’s only once,” and soon, the costs snowball.

According to a 2023 study by Hitched.co.uk, the average UK wedding cost is around £20,700. And while not all parents foot the entire bill, many contribute significantly, often more than they originally planned. Graduation events may not carry quite the same weight, but even modest celebrations can exceed £500–£1,500 once you factor in travel, formal wear, gifts, and group gatherings.

The key to avoiding these financial pitfalls? Treating the celebration like any other major household expense — with boundaries, clarity, and shared expectations.

Set a celebration budget before emotions take over

Start by asking one simple question: What can we truly afford without taking on debt or jeopardising our financial goals?

Whether it’s £500 or £5,000, define your ceiling. Then break the total down into clear categories.

Sample wedding expense breakdown:

- Venue & ceremony: 40%

- Catering & cake: 25%

- Clothing & styling: 10%

- Photography & video: 10%

- Decorations & extras: 10%

- Contingency: 5%

Sample graduation celebration breakdown:

- Travel & accommodation: 35%

- Attire (gown hire, suits/dresses): 20%

- Group meal or party: 25%

- Photos or keepsakes: 10%

- Gifts & extras: 10%

By mapping costs ahead of time, you give yourself a framework for spending decisions, making it easier to say no (or yes!) with confidence.

Talk openly with your child about financial expectations

This is their moment — but it’s still your money, and having a frank, respectful chat is essential.

Frame the conversation around transparency, not limitation. Try:

“We’re so proud of you and want to celebrate in a way that feels special. Let’s work together on a plan that feels right — for the heart and the wallet.”

By getting them involved in the planning, you not only reduce misunderstandings but also empower them to make realistic, value-driven choices.

Let them prioritise. Would they rather have a larger guest list or invest more in photos? Would they prefer a catered meal or a destination venue with close friends only?

Their answers may surprise you — and save you money.

Explore low-cost, high-impact celebration alternatives

Celebrations don’t have to be expensive to feel grand. In fact, some of the most meaningful events are intimate, personal, and creatively planned.

Budget-friendly graduation ideas:

- Host a backyard party with fairy lights, a DIY photo booth, and home-cooked food.

- Organise a picnic-style celebration at a local park.

- Create a digital photo album or memory video with messages from loved ones.

- Split costs with other parents for a joint event or group dinner.

Budget-smart wedding options:

- Choose off-peak days or months (midweek weddings are often half the price).

- Skip the traditional sit-down meal in favour of a food truck or buffet.

- Use public spaces (gardens, community halls) instead of private venues.

- Invite fewer guests and spend more per person, or go micro-wedding altogether.

Simplicity doesn’t mean sacrificing style or sentiment. It means focusing on what matters most and trimming the fluff that no one will remember in five years.

Track your spending carefully

Once you’ve set your budget, stick to it — and that means tracking every expense as you go.

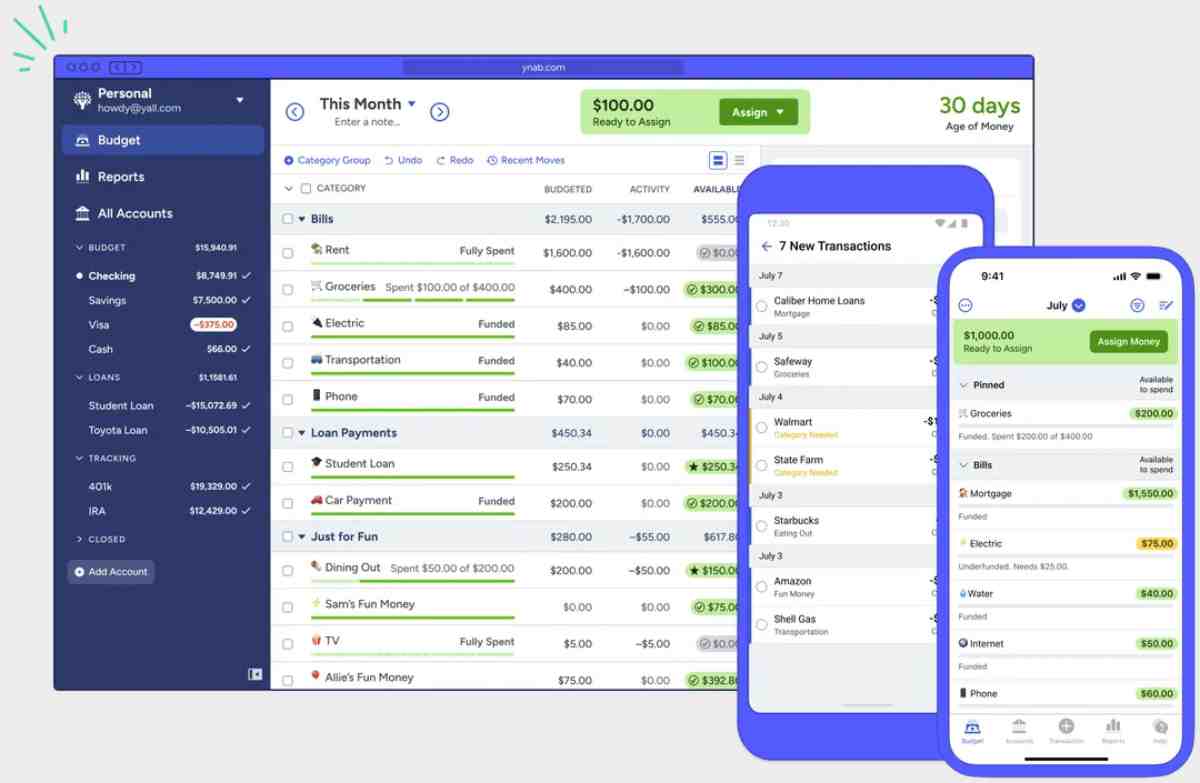

Create a shared spreadsheet or use free budgeting apps like:

- YNAB (You Need a Budget)

- EveryDollar

- Goodbudget

- Google Sheets (with real-time collaboration)

Log deposits, quotes, and actual spending. This not only keeps you on track but also helps you course-correct quickly if something goes over.

Consider creating a dedicated event fund or sub-savings account to keep celebration money separate from everyday expenses.

Don’t forget the hidden or last-minute costs

Even the best-laid plans have a way of springing surprises.

Think:

- Dress alterations

- Extra guests RSVPing late

- Tips for vendors

- Parking and transport

- Unplanned gifts

- Emergency purchases (umbrellas, heels, petrol!)

That’s why including a 5–10% contingency buffer in your event budget is so important. It keeps these surprises from turning into setbacks.

Consider ways to offset costs

If money is tight, it’s okay to explore cost-sharing, contribution, or creative financing ideas.

For weddings:

- Discuss cost-splitting with your child and their partner’s family — who’s covering what?

- Consider asking guests to contribute to a honeymoon fund instead of buying traditional gifts.

- Get help from talented friends — someone might offer photography, baking, or venue décor as their gift.

For graduations:

- Suggest pooling resources with classmates’ families for group events.

- Create a graduation gift registry with budget-friendly options.

- Book travel and accommodation well in advance or with points.

You can also encourage your child to contribute to their own celebration if they’re able — part-time job earnings, savings, or student budget allocations.

If you’re managing multiple financial priorities, building an emergency savings buffer helps ease pressure. Our guide to cutting expenses without cutting joy offers strategies that work year-round.

Stay grounded in your “why”

When you feel the pull to overspend, ask: What are we really celebrating here?

It’s not about impressing others or staging a picture-perfect day.

It’s about:

- Recognising a major achievement

- Supporting your child as they step into a new chapter

- Spending time with people you love

- Creating memories that feel authentic

Let those reasons guide your decisions, not marketing pressure or family politics.

A heartfelt speech, a shared laugh, and a group hug cost nothing but mean everything.

Manage post-event costs with care

Weddings and graduations don’t end when the music stops. There are thank-you cards, framed photos, maybe even lingering debts.

Make sure you:

- Plan a small budget for post-event extras

- Avoid putting large costs on high-interest credit

- Reflect on what went well and what you’d change next time

- Rebuild your savings pot gradually if you dipped into it

Celebrating is important. But recovering and rebalancing afterwards matters just as much.

If you’re juggling long-term expenses like education or home upgrades, our article on financial planning for growing families shares valuable budgeting insights.

Conclusion: Celebrate with clarity, not chaos

Managing wedding or graduation expenses as a parent isn’t easy, especially when your heart says yes to everything and your wallet says slow down.

But with honest conversations, practical planning, and a clear celebration budget, you can honour your child’s milestone without sacrificing your financial health. In doing so, you model what it means to be thoughtful, grounded, and financially responsible — a lesson more valuable than any venue upgrade.

So give yourself permission to keep it simple, say no to the extras that don’t serve you, and focus on what really matters: the people, the moments, and the memories you create together.

Your celebration doesn’t need to be expensive to be extraordinary. It just needs to be yours.