Budgeting Based on Needs vs Wants

Are you always wondering where your money disappears by the end of the month? You’re not alone. Many families feel like they’re doing their best but still fall short when it comes to savings or meeting financial goals. Often, the culprit is not how much we earn but how we spend. The secret to fixing that? Understanding the powerful difference between needs and wants.

Budgeting isn’t about being frugal for the sake of it. It’s about aligning your spending with your values. When you distinguish between what’s essential and what’s extra, you gain control over your finances—and your peace of mind.

In this article, we’ll break down how to tell needs from wants, how to make smarter financial choices, and how money mindfulness can keep your family budget on track. Whether you’re saving for a rainy day or trying to reduce debt, mastering this concept is a game-changer.

Why Understanding Needs vs Wants Matters

Budgeting priorities are often clouded by emotion and habit. We justify splurges as “deserved” or convince ourselves that a sale makes something a necessity. But when you take a step back, these decisions may not reflect your long-term goals.

Here’s why understanding the difference matters:

- Avoids unnecessary debt: Prioritising needs helps prevent overspending on non-essentials

- Clarifies decision-making: You spend with intention, not impulse

- Builds financial resilience: Less money wasted means more saved for real emergencies

- Encourages gratitude and mindfulness: You learn to appreciate what you already have

This shift is especially helpful when you’re managing a tight budget or transitioning to a single-income household.

What Are Needs, Really?

Needs are essentials—the things you genuinely require to survive and maintain a basic standard of living. Think food, shelter, healthcare, and transportation.

Examples of needs:

- Mortgage or rent

- Groceries (not gourmet meals, just nutritious basics)

- Utility bills (water, electricity, heating)

- Basic clothing

- Transportation to work or school

- Essential medical expenses

While needs can vary slightly based on personal circumstances, they should always form the backbone of your budget.

Defining Wants: The Tempting Extras

Wants are everything else. They may be nice, convenient, or fun—but they aren’t critical to survival. That doesn’t mean you should eliminate all wants, but it does mean you should evaluate them mindfully.

Common wants include:

- Streaming subscriptions

- Eating out

- Branded clothes or accessories

- Luxury personal care products

- Tech upgrades or home decor

- Fancy coffee or frequent treats

Understanding this distinction can be tricky. A gym membership may be a want for some, but a need for others managing a health condition. The key is to be honest with yourself.

Tools to Identify and Separate Your Spending

When you’re knee-deep in receipts and digital bank statements, it helps to have a process for sorting your spending.

Try the 50/30/20 Rule

One popular method divides your budget like this:

- 50% Needs

- 30% Wants

- 20% Savings and Debt Repayment

This structure allows you to be flexible while keeping your essentials covered. If your needs change by more than 50%, aim to adjust over time.

Use a Budgeting App

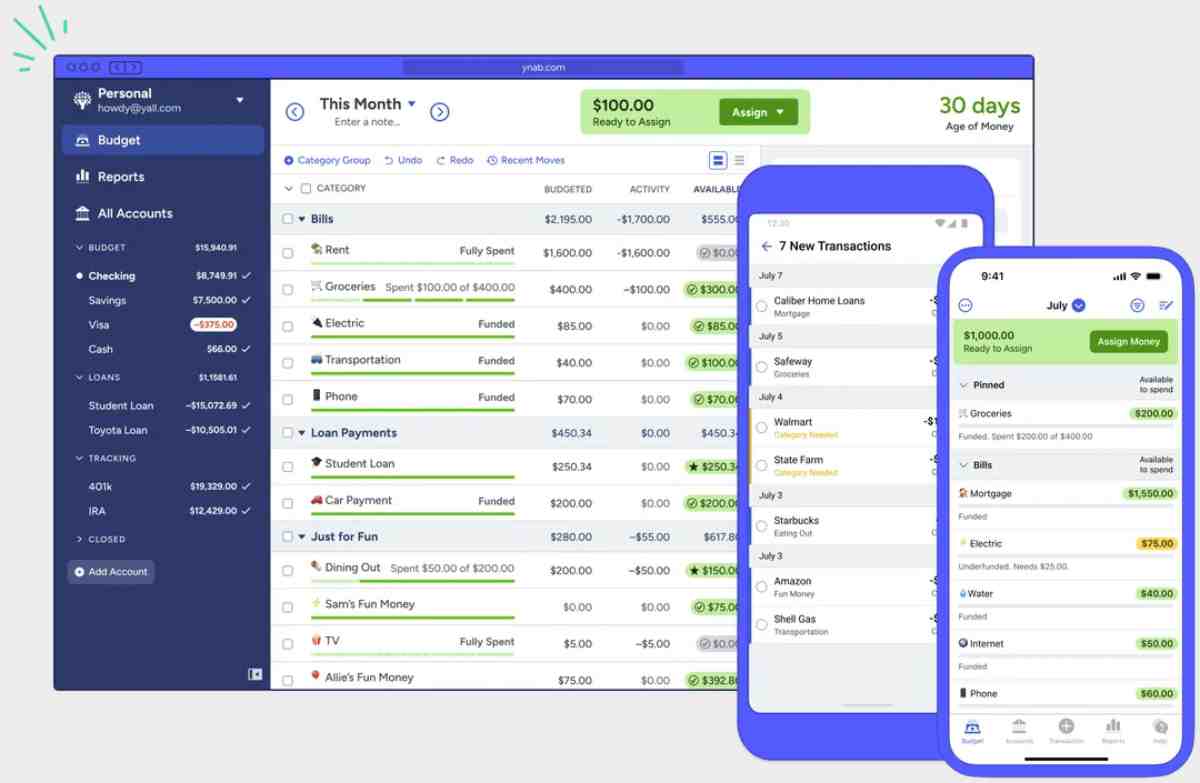

Apps like YNAB (You Need A Budget), Goodbudget, or even Google Sheets can help you categorise transactions. Many people are shocked when they realise how much goes to wants.

In fact, a minimalist family budget can help you streamline spending categories and reduce noise. The simpler your budget, the easier it is to stick to.

Mindful Spending in Real Life

The concept of separating wants from needs is easy in theory, but real life is messy. Let’s walk through a few real-world scenarios to see how this plays out.

Case 1: Grocery Shopping

You need food. But do you need name-brand snacks, pre-chopped fruit, or multiple packs of sparkling water? These can quietly inflate your food budget without improving nutrition.

Case 2: Back-to-School Spending

Your child needs a backpack, but do they need the trendiest one? Do they need ten new outfits or just a few practical ones?

Case 3: Family Entertainment

You need downtime, but that doesn’t mean expensive outings. Try swapping one paid event for a no-spend weekend idea—like hiking, picnics, or movie nights at home.

When in doubt, pause before buying. Ask: Will this bring lasting value or just temporary satisfaction?

Turning Wants into Occasional Treats

Wants don’t have to vanish completely. The goal is to reframe them as choices rather than defaults.

Tips for balancing wants:

- Budget for them: Create a “fun” fund with a fixed monthly limit

- Delay gratification: Wait 24 hours before non-essential purchases

- Celebrate milestones: Use wants as occasional rewards, not regular habits

This gives you the emotional benefit of treats without sabotaging your goals.

Teaching Kids to Know the Difference

Kids naturally want things. Teaching them to differentiate between needs and wants is a life skill that can serve them forever.

Ideas to instil this value:

- Involve them in budget planning for birthdays or holidays

- Play “need or want” games with shopping catalogues

- Let them earn money for small wants so they learn value through effort

You’ll raise kids who are not only financially literate but also more appreciative of what they have.

Needs and Wants Change with Circumstances

One often overlooked factor is that needs and wants evolve. What was once a want may become a need—and vice versa.

For example:

- During illness, a cleaning service might shift from want to need

- With a growing family, moving to a larger space may be essential

- As remote work increases, faster internet might move up the priority list

That’s why it’s important to revisit your budget regularly. Life isn’t static—and neither are your priorities.

Prioritise with Purpose

When you organise your spending by true priorities, budgeting stops feeling restrictive. It becomes empowering.

Focus on:

- Security: Cover your essentials first

- Simplicity: Reduce financial clutter

- Satisfaction: Choose spending that aligns with your values

You’re not just saving money—you’re buying peace of mind.

Final Thoughts: From Awareness to Action

Budgeting based on needs vs. wants is more than a strategy—it’s a mindset—one that brings clarity, confidence, and consistency to your financial journey.

Start small. Review your latest bank statement and categorise each item. Adjust gently but purposefully. Talk to your family. Invite them into the process.

The truth is, most of us don’t need more money—we need more intention.

So the next time you’re tempted by a flash sale or “buy one, get one free,” stop and ask: Do I need this? Or do I just want it?

Choose wisely, and your budget will thank you.